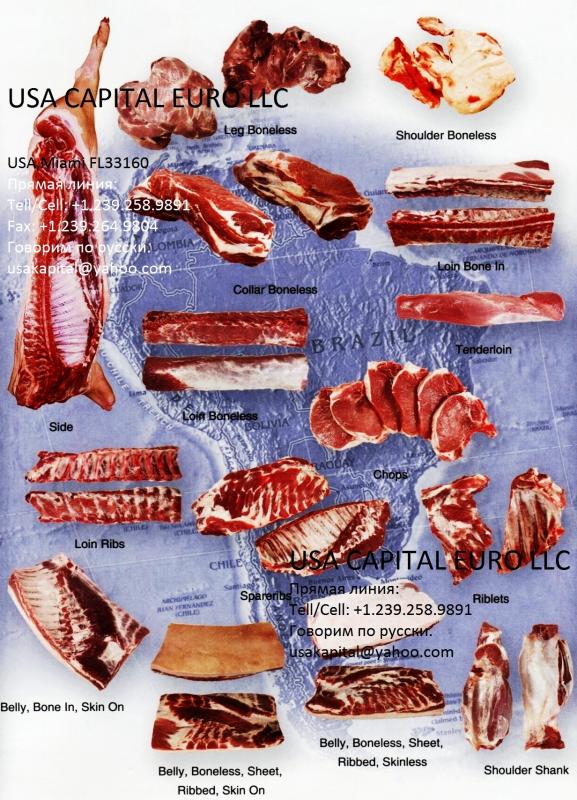

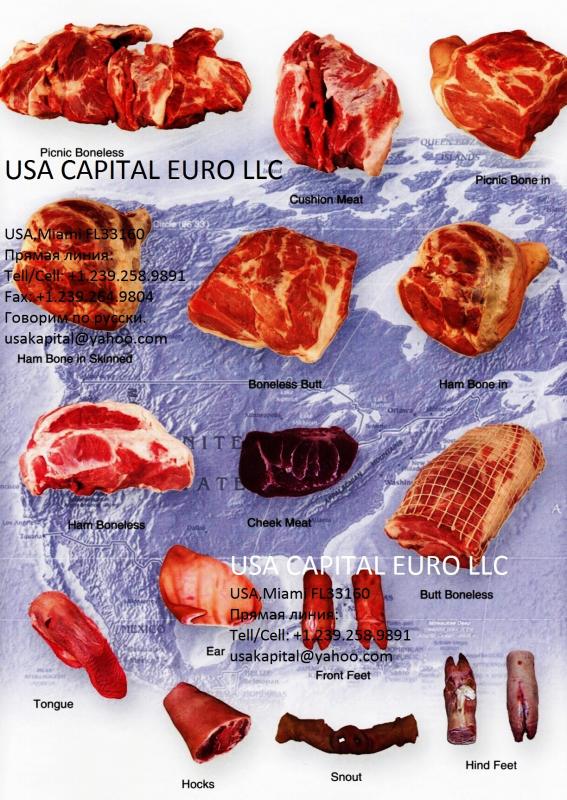

Наша Продукция, Мясо, Свинина, США, Бразилия, Аргентина

Наша Продукция, Мясо, Свинина, США, Бразилия, Аргентина

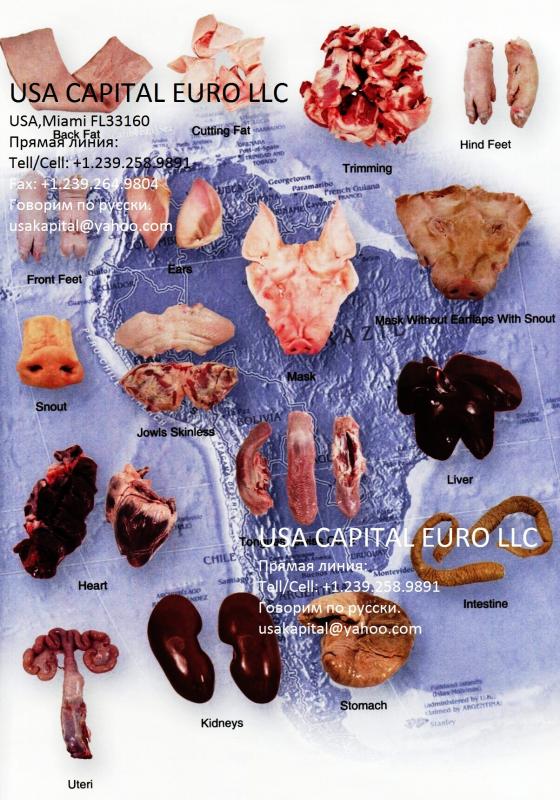

Поставки от USA CAPITAL EURO LLC:

1. Продукция Свинины, Говядины, Курятины

2. Предоставим Квоты на ввоз мяса на территории стран таможенного союза

By Donald E. Orr Jr. and Yingran Shen

and published in the Midwest Swine Nutrition

Conference 2008

Summary

The global production and consumption of pork has increased substantially in recent decades. This demand for pork clearly offers opportunities for both U.S. and foreign pork producers to expand international sales. Domestic demand for pork in individual countries is related to market size, supply and prices of competitive meats, per capita income effect on protein demand and pork demand’s vulnerability to currency or economic instability.

Pork production in countries dependent on high exports and also experiencing economic variation will cause returns to be lower and more variable. U.S. pork exports have been enhanced by the current low value of the U. S. dollar and the fact that Brazil has been unable to ship pork to key Asia markets due to Brazil’s Foot and Mouth disease related restrictions. Primary challenges for the U.S. pork industry are animal welfare, ethanol’s impact on feed stock price, labor availability, environmental/political issues and food safety/traceability programs.

While strong competition for export markets will come from both old and new pork producing countries, an improving global economic growth and rising demand for pork, especially in the Asian countries, will contribute to gains for U.S. pork production and exports.

Introduction

World pork consumption has increased by 27% from 2005 to 2010, with total global pork consumption for 2005 at over 93 million metric tons (MT). Pork is the meat of choice worldwide and offers opportunities for both U.S. pork producers and foreign pork producers to expand international sales. The value of U.S. pork exports in 2005 was $2.28 billion or $22.01 per U.S. hog slaughtered (Plain, 2010).

Top Pork Producing Countries

During this 5 year period, USA percent increase in pork production was 9.3% while the E.U.-25 increased by only 2.3% (FAS/USDA , 2010).

Liberalization of trade worldwide has resulted in significant increases in global trade in pork. It has become increasingly essential to be competitive in the global market, as this can contribute significantly to the profitability of a country’s primary pork producers (Young, 2005). To be competitive in the export markets will require:

- Low cost of production (not a guarantee for survival)

- Efficient production

- Quality and safety of products

- Reliability of supply

World Trade in Live Feeder Pigs and Slaughter Hogs

World trade in live hogs exported and imported for 2004, which includes feeder pigs and slaughter hogs, is presented in Table 2 (FAO, 2005). Canada heads the hogs exported list with 8.5 million head exported in 2004, while the USA imported in 2004 nearly the same number of live hogs to lead the list of hogs imported. The combination of pork exports and sale of feeder pig and slaughter hogs to the USA accounts for nearly 70% of Canada’s hog production.

This large export trade in pork and live animals reflects the response of the North American pig industry to it’s competitive advantages (Young, 2005). Canada has better herd reproductive efficiency than the USA, but the U.S. is very competitive in finishing pigs for market, along with a generally stronger American dollar so as to purchase pigs at a very competitive price.

Both the Netherlands and Denmark are large exporters of live hogs, with many of these going to Germany for feeding and slaughter or to Eastern Europe for feeding purposes. China is the primary provider of live market hogs for Hong Kong’s wet slaughter market.

Top Pork Importing and Exporting Countries

Top pork import countries

As shown in Table 3, Pacific Rims, Russia, and Mexico are the major pork import countries. Among those, Japan is the biggest pork importer. In 2005, Japan imported a record amount of pork with 1.339 MMT, over 1.2 MMT being generic pork (chilled and frozen combined) and 90 thousand metric ton of prepared and processed pork. There were increased imports from U.S., Chile, Canada, Mexico, Ireland, and Austria with a decrease from Denmark. This record number is in part, due to the tight supply of beef in 2004 (FAS/USDA, 2006).

Japan has the most strict import standard and labeling requirement. New Japanese food import standards may require more U.S. testing and could force some U.S. pork producers to change what they feed their hogs. The new rules change maximum residue limits on all food products for 799 feed additives, veterinary drugs and agriculture chemicals, compared to the previous number of 283 substances (Bratton, 2006). Producers may have to stop giving hogs these additives for a longer time before slaughter to meet new limits.

As emphasized by Liddell and Bailey (2008), the U. S. pork industry is generally lagging its principal international competitors of EU and major international customers in terms of developing programs for traceability, transparency, and assurance. If EU further differentiates themselves in these areas, the U.S. may lose its competitiveness in the world market, especially in Japan, as Japan emphasizes heavily on imported food labeling.

Mexico is the second biggest export market for U.S. pork. Mexico’s pork industry has not kept up with the rising domestic demand, and therefore Mexico has as deficit in pork production and is import dependent. Mexican consumer preferences for products and cuts not preferred in the United States help drive this market for chilled and frozen pork, variety meats, and processed meats and specific cuts for manufacturing, food service, and retail sale. Mexico is also a strong market for live hogs, although live hog imports have been less stable than have imports of pork and variety meats. Russia is the major export market for EU and Brazil. Russian market share of Brazilian pork imports increased from 57.8% in 2004 to 66.6% in 2010.

Top export countries

As shown in Table 3, EU and Canada export more pork than the US. However, EU’s export to Japan has decreased due to competition from the U.S., but EU’s export to Russia has increased. Although EU, especially west European countries, has high production cost, they identify their pork as high quality, customer oriented. EU hog production has changed from production oriented to market oriented, with emphasis on traceability and safety requirements.

EU will probably continue to be a strong competitor for the U.S. pork export market. Brazil is another major pork exporter. Brazilian pork exports in 2005 increased by 22.4% in volume. In 2005, Brazilian pork exporters increased their shipments of pork cuts, which now account for over 75 percent of all pork exports. The increase in pork cuts reflects the strategy of Brazilian exporters to increase profitability by exporting higher value products.

Beside the fact that China is the biggest pork producing country in the world and that most pork produced is consumed domestically, China is also a key player for pork export. However, China only exports live pigs to Hong Kong, and is now exporting some pork or processed meat to neighboring countries like Russia and South Korea.

Chile ranks 6th among the major pork exporters in the world (FAS/USDA, 2006), and has benefited from being one of the fastest growing economies in the western hemisphere with increasing integration in their hog industry. Chilean pork exports have grown significantly during the last decade, from 2,755 MT in 2005 to over 129,000 MT in 2010, with an esti mated 174,000 MT in 2006 for an average annual increase of over 40 percent. The main destinations for Chilean pork are Japan, South Korea, Mexico and EU member countries.

USA Pork Production

U.S. pork production is domestic dependent, producing 9.392 million MT, with an increase of 9.3% from 2005 to 2008 (FAS/USDA, 2009). The estimated industry total daily processing capability is 423,500 head, with major packers making up about 90% of this capacity. The ten leading packers each process more then 10,000 slaughter hogs daily, with Smithfield Foods having a capacity of nearly 110,000 head per day in the U.S.

Increasingly export driven, the U.S. exported 1.2 million MT in 2010, up 100% over the year 2005. Japan continues to be the largest foreign customer for U.S. pork, (45% of all U.S. exports), followed by Mexico and Canada. U.S pork exports have been helped by the currently low-valued U.S. dollar, and the fact that Brazil has been unable to ship to key markets due to Brazil’s Foot and Mouth disease (FMD)-related restrictions. U.S. hog slaughter has been complimented by increasing imports of Canadian feeder pigs for finishing and slaughter.

Economic predictions by Greenwood (2006) indicate that breakeven costs will be similar in 2012 as they are today. Ethanol production will lead to higher feed costs. Higher capital costs will occur in the replacement of older buildings. Thus, better production must occur to maintain current production costs. Opportunities for the U.S. pork industry include being able to play a dominant role in the global protein market. The potential exists for the U.S. to export up to 25% of the pork production by 2012, with China possibly emerging as a major export market (Greenwood, 2006).

Primary challenges for the U.S. pig industry are animal welfare (driven by food companies down to the producer level), ethanol use of the limited raw feed stocks, labor availability, and environmental/political issues. Food safety and traceability projects for quality assurance will be of foremost importance, especially as related to pork exports (Greenwood, 2006). Information systems on traceability will be required, as will technology to reduce labor costs. Segmented products will have differing breakeven costs and margins will become a focus point equally important as costs. A major compilation of worldwide pig production costs, feed costs and pig prices for 2005 was conducted by PIC, a worldwide breeding stock supplier. This summary indicated that the major countries with production costs below $1 US per kg live weight, starting with the lowest production costs, included Brazil, USA, China, Canada, Chile and Thailand (PIC, 2006)

Canada Pork Production

Unlike the U.S., Canada is a pork export-oriented country, as a result of policy change and modest population growth (Haley, 2005). Instead of exporting grains, Canada has developed a pork industry aimed at the export market since 1996. The production increased from around one million MT in early 1980’s to the current production of about two million MT. The Canadian pork industry broke export records in 2005, shipping 1.029 million MT valued at $2.84 billion Canadian. Currently, Canada exports more than 50% of its total production, as compared to that of 12.9% in the U.S. (FAS/USDA, 2010).

The relationship of the Canadian hog industry to its counterpart in the U.S. is complementary. In fact, among Canadian hog exports of around 8.5 million pigs in recent years (around 70% being feeder pigs), the great majority of these exports go to the U.S. and make up most of the imported hogs for the U.S. hog industry. This represents more than an eight times increase from ten years ago. In a competitive assessment, Canada has the advantage in farrowing, while U.S. has advantages in finishing and packing (Haley, 2010).

Вы всегда можете обратиться к нам напрямую по указанным ниже координатам, мы всегда рады начать долговременное сотрудничество.

Объемы поставок от 50-100 метрических тонн.

Пробные поставки от 25 метрических тонн.

Срок поставки 15-20дней с момента постановки судна на фрахт и оплаты.

--

USA CAPITAL EURO LLC

Tel: +1 239 258 98 91

Fax: +1 239 246 98 04

Skype: expo.invest

e-mail: [email protected]

www// Сайт компании

Создано на конструкторе сайтов Okis при поддержке Flexsmm - накрутка подписчиков вк

Soap 2 day